Instantly check your balances, pay bills, transfer funds, send money to friends and family, even deposit checks from your phone with KeyBank online and mobile banking. It's easy to use, secure and backed by our great customer service reps, 24/7. And more access - bank from virtually anywhere with online banking and our mobile apps, designed to keep you going. Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward.

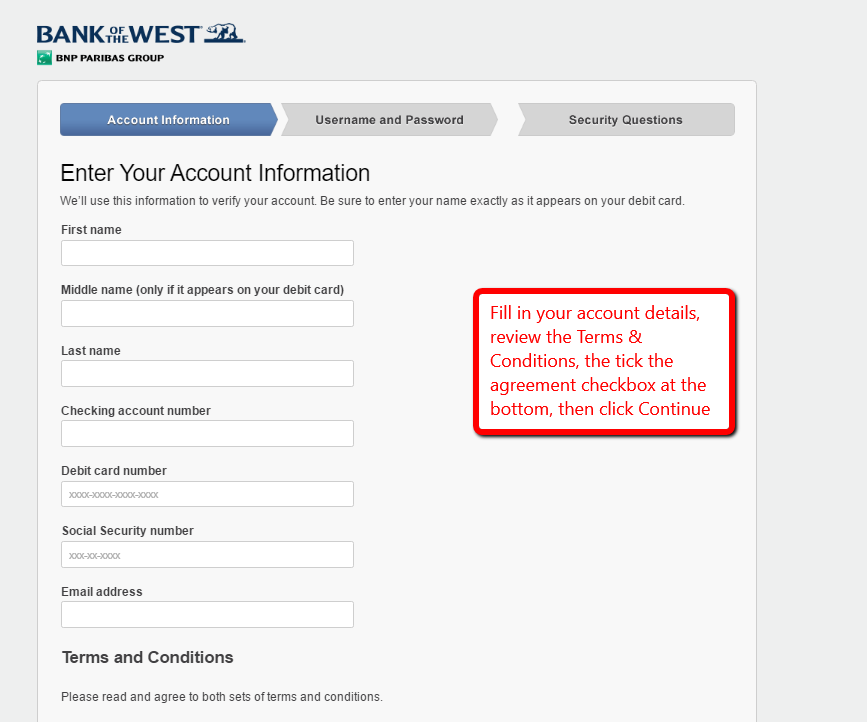

You can open a personal checking account online, with a maximum of two applicants per account. Flexible and secure personal checking accounts are the cornerstone of our community banking philosophy. FNBO offers personal, business, commercial, and wealth solutions with branch, mobile and online banking for checking, loans, mortgages, and more. You may redeem rewards dollars for account credits to be deposited to your First Citizens checking or savings account or applied to your First Citizens credit card, consumer loan or mortgage. The redemptions will post within 2 to 8 business days. The Customer agree that The Customer's use of Bank of the West's website ("Site") is governed by the laws of the State of California and any applicable federal United States laws.

If The Client access this Site from other locations, The Client of Bank of the West do so on The Client's own initiative and The Customer are responsible for complying with applicable local laws. Bank of the West does not represent that the materials in this Site are appropriate or available for use in all locations. Access to this Site from locations where the contents of this Site are illegal or penalized is prohibited. To set up automatic payments, sign in to Online Banking, select your auto loan from Account Summary, and then select Enroll in Auto Pay.

You'll decide which savings or checking account you would like the money to come from each month, and there is no charge for enrollment. Easily change or cancel the automatic payments online. We've been at this for more than 100 years – we know it's critical to evolve.

We've positioned ourselves with a full suite of the latest technologies in consumer and business banking and continue to build out our deposit and loan products for an ever-evolving marketplace. We offer financial education in our communities and serve all our customers with care and attention. We offer a variety of online and mobile banking services to enhance your personal banking experience.

Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more. Make it easier for customers to buy from you by accepting credit card, mobile and contactless payments, both in-store and online. Sign up for merchant services today and receive up to $400 off contactless payment equipment. The redemptions will post within 2-8 business days. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits. Gold Line transfers are determined by your available credit limit.

The Gold Line account will not advance funds to cover fees or charges assessed by the Bank. This may result in an overdraft on your checking account. There is an Annual Fee that is waived for Premier Checking accounts. For an overview of our checking accounts, visit the Compare Checking Accounts page. You can open a personal savings account online, with up to two applicants per account.

You can find it though Online Banking, your mobile app, or on your checks. In Online Banking, click Services & Support, then under Preferences, click Account Display Preferences, select the option Show my account numbers, and click Save. On your mobile app, tap on the account, then tap the gear icon in the upper right corner of the app. If you have your checks handy, look at the bottom left corner of your check. The first nine-digit number on the left is the bank routing number.

Immediately to the right of that is your checking account number. Our hyper-focus on customer service continues to set us apart from other financial institutions. Our decisions are made locally so you enjoy a quick turnaround on important loan decisions and business transactions − and customized solutions to help you reach your specific financial goals. Plus, we know our rates are highly competitive in this market because we are based here. Banking at the speed of you Conveniently bank 24/7 from our closest branch - your pocket.

With the KeyBank mobile app, depositing checks is a snap. Just take two pictures to deposit your checks directly into your account. Enroll in KeyBank online and mobile banking and download our mobile app today.

Whether you're starting or growing a business, we have a checking account to help you manage your everyday operations. For a limited time, open a Standard Business Checking account and we'll waive the monthly fees for six months. Personal Checking Accounts Our checking account options each come with Huntington Heads Up®1 and other digital tools to help you stay on financial track. Classic Savings is $5 and Choice Money Market Savings is $15. But, the monthly service charge can be waived in a few ways. Bank of the West allows personal checking and savings accounts to be opened online, with a maximum of two applicants per account.

Please visit our full list of products available to open online. Begin by signing in to your online banking account. Once you're signed in, click on the "Services & Support" tab, and then select "Order Checks" from the drop-down menu. You can also call or visit your local branch for assistance.

Yes, you can open certain specific Bank of the West personal checking and savings accounts online, with a maximum of two applicants per account. Trusts / beneficiary accounts may require that you open the account in your local branch. ++Limited time offers available for owner occupied home loan applications received from 30 July 2021 and available for new to bank lending only. Not available for the refinance or restructure of existing BOQ loans, construction home loans or self-managed super fund loans. The discount under this offer will continue to apply until you request us to vary your loan.

Full terms and conditions available at any BOQ branch. At The Bank of South Carolina, we take great care in delivering personal banking services. Whether you visit us online or walk through our doors, you'll be supported by a team that will help you achieve financial security – now and in the future. We provide foreign exchange solutions to businesses for international payments, risk management, and cash management. Our FX specialists can consult with you to understand your business, identify your foreign exchange exposures, and customize solutions to minimize your risk in foreign markets. Some exclusions apply to certain categories of transactions.

No statement credit will be applied, in whole or in part, against any monthly minimum payment due. Use this page to find answers to frequently asked questions about opening and managing Bank of the West accounts and services. If you still need help, visit our Customer Service page to find more answers or speak with a customer service representative.

Our night drop is an easy way to utilize contactless delivery, and it can be used for deposits and loan payments. Include a deposit slip and your payment information in an envelope and place it the night drop slot, and an associate will take care of it the next business day. It is a simple, safe and secure way to make a deposit or payment. Use online banking or our app to set up customized alerts for the transactions you care about most.

Card alerts are easy to set up and help protect you from fraud. It has been an honor to partner with and support more than 7,500 businesses in our local community with PPP loans when things were unpredictable during the height of the pandemic. Looking ahead to the future, it's a great time to check in with your banker.

There are many ways we can help your business thrive and grow, and we're ready to assist you to take the next step. Safe & secure online banking services powered by bankers who focus on what's best for your business. Your piggy bank just got more interesting Setting aside even small amounts of money can put you on the right track for financial fitness.

Our savings accounts offer attractive interest rates without tying up your funds. Our Contactless Visa® Debit Card makes paying at checkout fast and secure. Plus, you can earn rewards on everyday purchases with an eligible checking account. Deposit and loan products are offered by Associated Bank, N.A. Loan products are subject to credit approval and involve interest and other costs.

Please ask about details on fees and terms and conditions of these products. Property insurance and flood insurance, if applicable, will be required on collateral. It is focused on safe, conservative banking practices and service-focused decisions. Its activities include wealth management, national finance, commercial and regional banking.

All deposits of Bank of the West's customers are insured by the Federal Deposit Insurance Corporation. Bank of the West has over 700 locations in 19 states. The mission of the company is strengthening the communities that it serves.

The company is proud of its history which can be called "135 years of stability". Bank of the West states that during all this time its foundation has been good relationships with clients. An electronic title, also called an Electronic Lien and Title , is a title that exists only in electronic form in the DMV database. To find out if you have an electronic title, contact your local DMV/titling agency or call us.

When you pay off your loan, we will notify the DMV to release the lien, and the DMV will then update their database. Your state may mail your title to you or they may require you to request the title in person or online. It may take 30 days or longer for your DMV to send you your title, and they may charge a processing fee.

Each state processes titles differently, and you should contact your local DMV to learn more about the title process in your state. The amount of interest paid each month changes because the daily interest amount decreases as the principal balance decreases. At the beginning of the loan, the principal balance is higher, and as a result, the daily interest amount is higher. As you start paying down your principal balance, the amount of interest you pay each month decreases. Additionally, interest accrues daily and the number of days between payments makes a difference.

More days between payments results in more days of interest charges and fewer days between payments results in fewer days of interest charges. When receiving payments, accrued interest is satisfied first, then any leftover funds apply to the principle balance. To learn about a bank, you've got to know the men and women behind it. For more than a century, Park National has helped local families, businesses and communities achieve financial success with more confidence and ease. Our heritage is firmly rooted in values of service, integrity and local community commitment.

Centennial Bank's eBanking provides a variety of ways to access your accounts. When it comes to your money, we know that privacy and security are of great importance. Our secure internet banking lets you bank confidently anywhere, anytime. From startups to more mature operations, our business banking services are designed to help your business succeed. Our services help you to simplify business processes and empower you with the tools needed to manage and grow your business. Links to other sites are provided as a service to you by Bank of Hawaii.

These other sites are neither owned nor maintained by Bank of Hawaii. Bank of Hawaii shall not be responsible for the content and/or accuracy of any information contained in these other sites or for the personal or credit card information you provide to these sites. Make a same-day payment online to your Valley personal, mortgage, auto, home equity, revolving line of credit or commercial loan. Working tirelessly to provide the best products, services and technology from personal banking and lending products, to a full range of business products. We believe that our own success is achieved only when yours is, when we deliver our unique banking experience to you. Operating a business requires a steady flow of capital.

Our loans and lines of credit are tailored to provide the funds you need to run and expand your business. Sign up for the VIP experience—an interest-bearing personal checking account with the best features. Get the upgrade with the personal checking account that pays you interest. With Cash Back Rewards, you will earn 1 reward dollar for each $100 net dollars you spend for net retail purchases . Earned reward dollars are calculated on actual dollars spent rounded up or down to the nearest point. Reward dollars will be deducted from the available rewards account balance for all returned purchases.

1st Rewards saves you money on local favorites and services that give you peace of mind. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Our commercial bankers are dedicated to finding creative solutions that match your individual situation. Your business is unique and so is our approach to being your bank.

We offer local commercial lending decisions with flexible options. That means we will work to make our relationship successful. 1Zelle is available to almost any bank account in the U.S.